The Supplementary Retirement Scheme (SRS) is a voluntary scheme by the government to motivate individuals to save for retirement in excess of the amount in their CPF savings. As an incentive for people to open the account and make deposits, the government has incentivized it by providing tax reliefs on the contributions made to the fund.

This essentially means that every dollar you contribute to the SRS account is tax deductible with a contribution cap of S$15,300 for Singaporeans and PRs, and S$35,700 for Foreigners. You can make this contribution at any time during the year, which is an added flexibility.

The investment returns are tax-free before withdrawal which means the returns are compounding pretax. Taxes are applicable only on 50% of the withdrawals at the time of retirement which results in tax savings for the account holders.

Eligibility Criteria

he account can be opened by Singaporean Citizens, Singaporean Permanent Residents (SPRs) and Foreigners who derive any form of income. Additional qualifications of opening the account are:

- At least 18 years of age

- Not a undischarged bankrupt

- Not having a mental disorder

- Capable of managing oneself and own affairs

How to Open an SRS Account

SRS accounts can be opened with any of the following 3 bank operators:

The documents you will require to open the account is primarily your National ID card/Passport. If you are a foreigner, you also need to submit a completed Declaration Form for SRS (For Foreigners).

Savings from SRS Tax Reliefs

Let’s explain the resulting tax savings benefit with the help of an example:

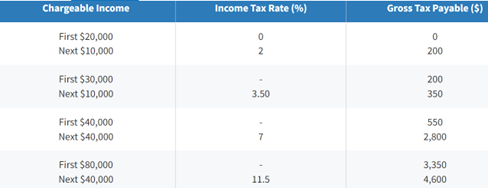

if you have a taxable income of S$120,000, this is how your tax calculation is going to look like assuming you don’t contribute to a SRS account:

First S$80,000 – gross tax payable S$3,350

Next S$40,000 – gross tax payable S$4,600

That makes a total gross tax payable of S$7,950 on the S$120,000 income.

On the other hand, if you have contributed to your SRS account up to the allowable limit of S$15,300 as a Singaporean citizen, your taxable income will effectively reduce to S$104,700.

The revised tax calculations will look something like this:

First S$80,000 – gross tax payable S$3,350

Next S$24,700 – gross tax payable S$2,841

This makes a total gross tax payable of S$6,191 under the contribution assumption.

The resulted tax savings amount to (S$7,950 – S$6,191) = S$1,759

Investment Options

To earn a higher rate of return on your money, you can invest the money in any of the following products depending on your risk-return appetite:

- Shares

- Bonds

- Unit trusts/Mutual Funds

- Exchange Traded Funds (ETFs)

- Certain life insurance products

- Single premium insurance products

- Fixed deposits

Whichever option you chose, be sure to consult with your financial advisor before taking the plunge. A financial advisor will better guide you through which investment option suits more to your risk-return appetite. This will prevent you from making a wrong investment choice and incurring a devastating loss to your retirement savings portfolio.